Gold bars

Contents

What Are Gold Bars and Why Invest in Them?

Gold bars, also called gold ingots or bullion bars, are refined pieces of gold and a popular way to invest in precious metals. They protect against economic problems, inflation, and currency drops. Investing in gold bars can give steady returns and diversify your investments. Gold's value is recognized everywhere, tending to make it a reliable asset that keeps its worth over time, regardless of political changes or inflation. This makes gold bars a top choice for preserving wealth and ensuring financial security for investors around the world.

Gold bars are a valuable addition to investment portfolios that can help protect wealth for the future. Gold has many benefits, including being an excellent hedge against failing governments, rising inflation, and failing fiat currency.

Gold values are not affected by many economic and political changes, and tend to rise in price with the pace of inflation, making it a good type of financial insurance offering stable returns and portfolio diversification for almost anyone. A gold bar is sometimes referred to as a gold ingot or gold bullion bar. A bar is shaped from refined metallic gold. A bar of gold is measured by the troy ounce (troy oz).

Gold is loved and cherished around the world. From the people of the United States to the British, from Africa to South America, whether Chinese or Australian, Queen or citizen, a client or the press, gold is considered valuable.

You may not be able to walk into an Apple Store at your shopping mall and buy the newest iPhone with a bar of gold, but that bar is likely going to fetch you plenty of cash to be able to buy the phone of your choice.

Find out why buying bars in gold bullion content is one of the most coveted types of precious metals for a wide array of investors.

How Can You Buy Gold Bars Online Safely?

To buy gold bars online safely, consider buying directly on the Money Metals Exchange website. Money Metals Exchange is a reputable precious metals online dealer that has been well-established since beginning in 2010. Money Metals has acquired an A+ rating with the Better Business Bureau (BBB) and has received thousands of 5-star customer reviews on various platforms. Even Investopedia has recognized Money Metals Exchange as the Best Overall Precious Metals Dealer in the U.S. The Money Metals Exchange website is safe and secure making transactions through the website equally protected. All gold bars are tested for their weight, purity, and authenticity. Money Metals Exchange offers competitive pricing and quick delivery. Every order comes with tracking and requires a signature upon delivery. Overall, Money Metals Exchange offers gold bars at exceptional prices, with secure transactions, and safe deliveries. The best way to buy gold bars online safely is through Money Metals Exchange.

What Are the Common Weights and Types of Gold Bars Available?

Gold bars are commonly available in a variety of weights and types, catering to different investment preferences and budgets. Here are some common weights and types of gold bars:

- 1 gram: These are small, affordable gold bars ideal for those who are new to investing in precious metals or have a limited budget.

- 2.5 grams: Slightly larger than 1-gram bars, these are still relatively small and offer a convenient way to invest in gold without committing to larger amounts.

- 5 grams: A popular choice for investors looking to accumulate gold in larger quantities while still maintaining affordability and flexibility.

- 10 grams: These bars are larger and offer better value for investors looking to invest larger sums of money in gold. They are also relatively easy to store and transport.

- 1 ounce (31.1035 grams): One of the most common weights for gold bars, these are widely traded and recognized by investors and dealers around the world.

- 5 ounces: These larger bars are popular among serious investors looking to accumulate significant amounts of gold in a single purchase.

- 10 ounces: Another popular choice for serious investors, 10-ounce gold bars offer a cost-effective way to acquire larger quantities of gold while still being relatively easy to store and transport.

- 1 kilogram (32.1507 ounces): These large bars are typically purchased by institutional investors or those looking to make substantial investments in gold. They offer the best value for investors looking to buy gold in bulk.

In terms of types, gold bars can be categorized based on their production methods and design features. Some common types include:

- Cast Bars: These bars are produced by pouring molten gold into molds and allowing it to cool and solidify. They typically have a rough, uneven appearance and are less expensive than other types of gold bars.

- Minted Bars: Minted bars are produced by stamping or pressing gold blanks to create uniform shapes and designs. They often have a smooth, polished finish and may feature intricate designs or markings from the mint.

- Poured Bars: Similar to cast bars, poured bars are made by pouring molten gold into molds. However, poured bars are typically handcrafted and may have a more refined finish compared to cast bars.

- Combibars: Combibars are unique gold bars that can be easily divided into smaller units, making them ideal for bartering or emergency situations. They consist of smaller interconnected bars that can be broken off individually.

These are just a few examples of the common weights and types of gold bars available. When purchasing gold bars, it's important to consider factors such as weight, purity, design, and production method to find the best option for your investment goals and preferences.

How Do the Purity and Fineness of Gold Bars Affect Their Value?

The value of gold bars is significantly influenced by their purity and fineness. Purity refers to the amount of gold present in a bar relative to other metals or impurities and is typically measured in karats or fineness.

For example, 24-karat (24k) gold is considered pure, while 18-karat (18k) gold is 75% pure. On the other hand, fineness is expressed as a percentage or in parts per thousand, indicating the proportion of pure gold in the bar. A gold bar with a fineness of .9999 contains 99.99% pure gold. Generally, higher purity and fineness levels result in greater value because pure gold is scarce and highly desirable.

Investors tend to prefer gold bars with higher purity and fineness due to their intrinsic value and stability against market fluctuations. Bars with higher purity contain more pure gold and are less affected by changes in the value of other metals or impurities. Consequently, they command higher prices in the market.

Moreover, gold bars with higher purity and fineness levels are more widely recognized and accepted by dealers, banks, and investors globally. They are considered standard units of trade in the gold market, making them more marketable and easier to buy, sell, and trade without extensive testing or verification.

Furthermore, gold bars with higher purity and fineness levels offer practical advantages in terms of storage and transportation. They are more compact and dense because they contain less non-gold material, making them easier to store and transport in large quantities. This makes them more cost-effective for investors who hold significant amounts of gold as part of their investment portfolio.

In summary, the purity and fineness of gold bars directly influence their value, with higher levels typically resulting in higher prices, greater marketability, and practical advantages in storage and transportation. Investors should consider these factors when purchasing gold bars to ensure they obtain the best value for their investment.

What Are the Most Popular Designs of Gold Bars for Investors?

The most popular designs of gold bars for investors often come from reputable mints and refiners around the world. However, most investors do not invest in gold bars for their designs, rather they tend to invest in gold bars for the weight and purity of the gold bars themselves. Nevertheless, here are some of the most sought-after designs:

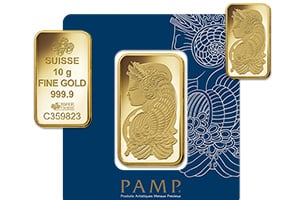

- PAMP Suisse: Renowned for intricate designs and high-quality craftsmanship, PAMP Suisse produces gold bars featuring iconic themes such as Lady Fortuna, wildlife, and historical figures.

- Credit Suisse: Known for elegant yet simple designs, Credit Suisse gold bars feature the brand logo, weight, purity, and serial number stamped on the obverse side, ensuring recognition and trust among investors worldwide.

- Perth Mint: Highly respected for quality and purity, Perth Mint gold bars often showcase iconic Australian symbols like the kangaroo, swan, or koala, making them popular among collectors and investors alike.

- Royal Canadian Mint (RCM): Alongside its famous Gold Maple Leaf coins, the Royal Canadian Mint produces gold bars with the mint logo, weight, purity, and serial number stamped, providing assurance and reliability to investors.

- Valcambi: Known for its Swiss craftsmanship, Valcambi gold bars feature elegant yet straightforward designs and are highly sought after for their purity and quality.

- Geiger Edelmetalle: Geiger Edelmetalle produces gold bars recognized for their quality and purity. Their bars often feature the iconic Schloss Güldengossa castle design, symbolizing their German heritage.

- Argor-Heraeus: Argor-Heraeus gold bars are renowned for their Swiss craftsmanship and purity. Their bars feature the mint logo, weight, purity, and serial number, ensuring authenticity and trust.

- Metalor: Metalor gold bars are known for their high-quality production and purity. With a simple yet elegant design, Metalor bars are sought after by investors for their reliability and reputation.

- Sunshine Minting: Sunshine Minting produces gold bars with a focus on quality and authenticity. Their bars feature unique security features such as MintMark SI technology, providing added assurance to investors.

- Istanbul Gold Refinery (IGR): Istanbul Gold Refinery is known for its quality gold bars and innovative designs. Their bars often feature intricate patterns and designs inspired by Turkish culture.

- MintID: MintID offers gold bars with cutting-edge technology, including AES-128 bit encryption and MintID's patented VeriScan technology, allowing investors to authenticate their bars easily.

- Republic Metals Corporation (RMC): Republic Metals Corporation produces gold bars recognized for their quality and purity. Their bars feature a simple yet distinctive design, making them popular among investors worldwide.

These reputable mints and refineries offer a diverse range of gold bars, each with its own unique designs and features, catering to the preferences and needs of investors in the precious metals market.

Should I invest in gold bars or coins?

When considering whether to invest in gold bars or gold coins, it is important to know what your end goal is. If you want to collect gold coins for the sake of their aesthetic appeal, gold coins are certainly beautiful in appearance. However, if you want to make the most return on investment, the better option is to invest in gold bars.

Gold coins often come with higher premiums compared to gold bars. This means you may pay a higher price per ounce of gold when purchasing coins. Gold bars, particularly larger ones from reputable refineries, tend to have lower premiums, making them more cost-effective for investors looking to acquire larger quantities of gold.

Gold bars are available in a wider range of sizes compared to coins, allowing investors to choose the specific weight that best suits their investment budget and goals. Coins, on the other hand, typically come in standard sizes such as 1 ounce or fractions thereof. This flexibility in sizing can make gold bars more attractive to investors who want to tailor their investments to specific amounts or require a lower barrier to entry.

How Can Investors Store Gold Bars Securely?

Investors can store gold bars securely at the Money Metals Exchange Depository. The Money Metals Exchange Depository provides a secure solution for storing gold bars, and other precious metal items, aligning closely with the criteria for secure storage. It boasts state-of-the-art security features, including custom-built construction using thick steel and hardened concrete. Top-of-the-line UL Class 3 vaults and 24-hour monitoring systems ensure the highest level of protection for stored assets. Moreover, the depository is located in low-crime Eagle, Idaho, adjacent to the county sheriff's office, further enhancing its security profile.

Assets stored at the Money Metals Exchange Depository are fully insured by Lloyd's of London, providing clients with peace of mind against potential loss or damage. The depository operates independently from banks, Wall Street, and government institutions, ensuring the security and integrity of clients' holdings. This independence offers an additional layer of protection, removing assets from the risks associated with traditional financial systems.

The Money Metals depository offers convenient access to stored assets, allowing clients to manage their holdings easily through online portals. Clients can add metals to their accounts, sell holdings, or request shipments without hassle. Transparency and accountability are maintained through regular internal audits conducted weekly and third-party audits conducted annually. Clients have complete visibility into their holdings through online tools and account notification procedures, fostering trust and confidence in the storage process.

Money Metals Exchange Depository provides secure storage services at competitive rates, making it an affordable option for investors seeking to safeguard their gold bars. Overall, it offers a secure, transparent, and cost-effective solution for storing gold bars, meeting the stringent requirements of investors concerned with asset protection and risk mitigation.

How Much Do Gold Bars Cost?

The cost of gold bars fluctuates based on a variety of factors, including market demand, purity, and weight. As of the latest data, the price of a 1-ounce gold bar is approximately $2,170.02, while a 1-kilogram gold bar could cost around $69,767.76.

It's important to note that these prices are subject to change due to the dynamic nature of the gold market.

Investors interested in purchasing gold bars should keep in mind that gold is priced per gram or ounce, with the spot price of gold serving as a base for these calculations. Additionally, gold bars are sold at a premium over the spot price, which covers the costs of minting, distribution, and a dealer's margin.

Investing in gold bars can be a strategic move for those looking to diversify their investment portfolio or hedge against inflation. Gold has historically been a stable investment, maintaining its value over time compared to currency, which can fluctuate in value. When considering investing in gold bars, it's crucial to conduct thorough research and monitor the market for the best entry and exit points. This approach can help investors maximize their returns by buying low and selling high.

Gold bars, recognized internationally for their value, can be a solid addition to an investment portfolio, offering the potential for high performance and wealth preservation.

How Do Gold Bars Compare to Other Precious Metals for Investment?

Gold bars are a popular choice for investment due to their long-standing reputation, stability, and global recognition, especially when compared to other precious metals for investment. Gold offers a range of advantages, including stability and liquidity. Gold is known for maintaining its value over time, particularly during economic downturns, making it a reliable investment. It is widely recognized and easily traded globally, ensuring liquidity for investors.

Additionally, gold often appreciates during times of inflation, serving as a hedge against currency devaluation. Gold's density and resistance to tarnishing make it easy to store long-term without degradation. However, gold's high price can be a barrier for small investors, and its primary value lies in investment and jewelry, with limited industrial applications.

Gold bars are ideal for stability, and liquidity, and as a hedge against economic uncertainty. Silver bars offer affordability and high industrial demand, making them suitable for smaller investors and those looking to capitalize on industrial growth. Platinum and palladium bars provide opportunities for diversification and potentially higher returns due to their industrial uses but come with higher volatility and lower liquidity. Investors should consider their investment goals, risk tolerance, and market conditions when choosing between these precious metals.

What Are the Advantages of Buying Gold Bars from Reputable Dealers?

Buying gold bars from reputable dealers, such as Money Metals Exchange, offers significant advantages, ensuring a secure and reliable investment. These dealers guarantee the authenticity and quality of their gold bars, sourcing from trusted mints and manufacturers to meet specified purity and weight standards. Transparency in pricing, detailed product information, and a strong reputation for trustworthiness build investor confidence. Additionally, Money Metals Exchange provides robust buyback policies, secure transactions, and excellent customer service, ensuring a smooth and satisfactory purchasing experience. The dealer's commitment to compliance with relevant regulations adds another layer of security for investors.

Money Metals Exchange stands out as the best overall precious metals dealer, offering a wide range of gold bars from various mints and manufacturers. This variety allows investors to select from different sizes, weights, and designs, catering to specific investment needs and preferences. The dealer's strong reputation, backed by positive customer reviews and a track record of satisfied clients, underscores their reliability. By adhering to stringent security measures and providing expert advice and support, Money Metals Exchange ensures that investors can make informed decisions and protect their investments effectively.